Last month’s commentary aptly titled Nobody Knows Anything elicited a strong response, mainly in agreement that the conventional methods for valuing most businesses are currently inoperative. If you cannot calibrate risk, you cannot come up with a risk-adjusted view of value. Thus, the deals that were and are getting done fall into a handful of categories in which the investment proposition makes sense notwithstanding the temporary loss of traditional metrics.

Now, a month further into this unprecedented COVID-19 Spring, partial clarity is returning to the market. It is possible to assess industries categories and sub-categories likely to normalize sooner rather than later. This article sets out a construct for making this assessment.

Winners and Losers

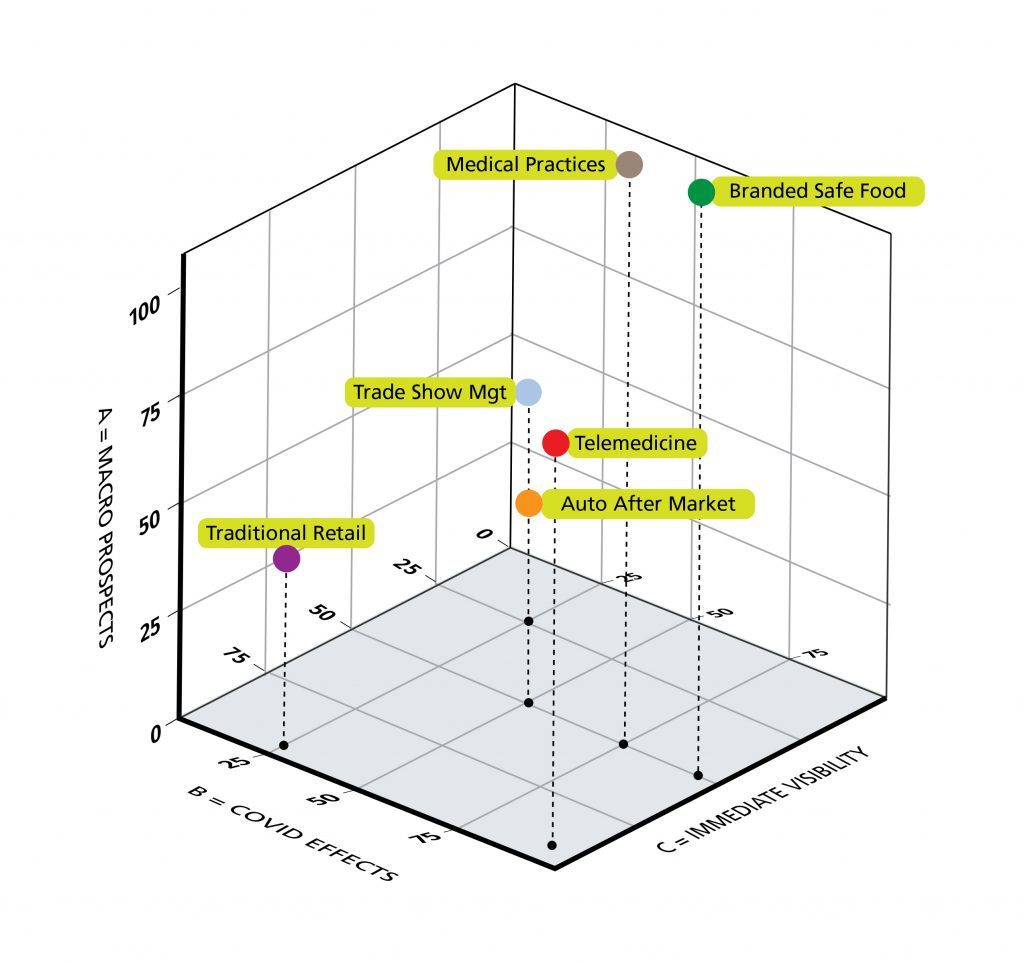

It is widely noted that the pandemic is creating winners and losers. These judgments are largely a function of three considerations: (a) the long-term growth prospects for a given business as they existed prior to and independent of coronavirus; (b) the impact of the virus on those prospects; and (c) the likelihood of immediate visibility on normalized business performance based on the interplay between (a) and (b).

The chart below plots six types of businesses according to these considerations. Please note these are illustrative generalizations, not definitive assessments of every company in a given industry.

Let’s take a look at each industry in turn:

Telemedicine: The paradigmatic example of a good industry made indispensable by unprecedented events. While the upside for individual businesses remains to be determined, this is one of several healthcare-related applications likely to see immediate transaction activity.

Branded safe food: A subset of consumer product manufacturers was attractive four months ago because they had developed brands around healthy living, local or tightly managed supply chains and environmentally sensitive operating techniques. For many not all of these businesses, the value proposition has been enhanced by greater attention to safe food and work environments. These businesses are also likely to trade, though it may take a little more time to sort out the enduring nature of these newly prominent investment considerations.

Medical practice consolidation: Another extraordinarily hot area in the prehistoric days of early 2020. Still driven by the same favorable macro considerations, but at least some will face an undertow. This is the flip side of telemedicine’s achieving greater acceptance. Some physician practices and other health care applications gravitated toward attractive, quasi-retail settings that made perfect sense a few months ago but may now need to be retooled to work in an era of remote patient care. Overall favorable dynamics but may take the buyer/investor universe time to digest.

Automotive after-market: My best effort to find a business close to the midpoint on all three axes. A fundamentally good business, but with pre-existing secular questions longer lived automobiles, evolution to more electronics and self-driving features, movement away from fossil fuels, more sales via the internet. Now, a raft of new questions will be commuting and travel patterns change? Will consumers be keeping cars longer, taking demand away from OEMs? Not all bad, not all good, but it will take some time to sort out.

Travel-related business services: An amorphous category but one we all can recognize. Outsourced trade show management, for example, was a high-margin, well-positioned niche that has been thrown into disarray. We simply do not know which changes in business travel and networking practices will turn out to be permanent and which will prove to be transient. For many operators, the best path will be to stay put for the next couple of years, if they have the financial staying power to do it.

Traditional retail: Pre-COVID, bricks, and mortar retailers had some period of time to transition to more competitive physical formats and internet trade. Most would not have made it, but there would have been a handful of successes. This longer runway has been compressed into a short and immediate period of distress. As a result, retail will be an active arena for transaction activity, encompassing both going concerns and brands no longer associated with operating businesses.

Concluding Thoughts

The greatest benefit advisors and investors in closely held companies can provide right now is to help business owners figure out “who they are” where they are likely to fit in this new world.

Although it is not too soon for us to be making these assessments, most private owners are not there yet. They are focused on their own performance, employees, bank relationships, and other virus-related effects. The story in our industry over the next 90 days will be the extent to which more of them are prepared to engage in this process of discernment. Business buyers are, of course, already at the table. We will see the extent to which sellers join them.

It seems clear, though, that cash-flow based lenders will be the last to arrive. They are dealing with troubled current investments and will contain to be impaired by challenges in assessing risk associated with new platform commitments. Accordingly, to the extent transaction activity comes back in the second half of this year, it is more likely to involve strategic buyers and financial buyers not reliant on debt loads anywhere close to past practice.

What will be the valuation environment as seller interest resurges? Impossible to say. As you may have heard, nobody knows anything. It is likely, though, that the closer a business is to the upper and outermost corner of the cube above, the more likely it is to be valued at multiples approaching pre-virus levels.

About the Author

Andy Greenberg is CEO of GF Data® and of Greenberg Variations Capital, a mergers & acquisitions advisory firm devoted to one-off or targeted transactions. GF Data is the leading provider of valuation, volume, leverage and key deal term information on private transactions in the $10 to $250 million value range. GF Data and GVC are both based in suburban Philadelphia. All charts and data are subject to the terms of use of the sources cited in this commentary.

Andy Greenberg is CEO of GF Data® and of Greenberg Variations Capital, a mergers & acquisitions advisory firm devoted to one-off or targeted transactions. GF Data is the leading provider of valuation, volume, leverage and key deal term information on private transactions in the $10 to $250 million value range. GF Data and GVC are both based in suburban Philadelphia. All charts and data are subject to the terms of use of the sources cited in this commentary.

For information on subscribing or on contributing data as a private equity participant, please contact Bob Wegbreit at bw@gfdata.com or at 610-616-4607.