When GF Data published its various year-end reports last month, the analysis seemed to confirm what many business buyers and deal professionals had already drawn from their own experience.

The primary drivers of middle-market deal flow — company and industry performance, capital availability, macro-economic conditions, and public equity values — are more favorable to the private business seller than at any time since the mid-2000s, but the volume of change-of-control deal activity is just not on par with these favorable market conditions.

So, where are the private business sellers? And, if this accommodating environment is not inducing them to sell in greater volume, what will?

For the past 18 months, our nearly 200 private equity data contributors have characterized the seller in each reported transaction as individual/family business owners, private equity/financial, corporate or other. This enables us to examine patterns in transactions with “non-institutional” sellers — sole proprietors, individual business partners, family owners — as distinct from “institutional” entities — private equity firms, other financial buyers and corporations. (Private equity data contributors report on deals they complete in the $10 to 250 million Total Enterprise Value (TEV) range).

There were pronounced changes in the non-institutional cohort from the first to second half of 2013. The data confirms the suspicion that this group is more motivated by intangible factors, less likely to move based on holding periods or other external mileposts, and is more inflexible in adjusting purchase price expectations in response to due diligence or other issues that develop in a transaction’s later stages.

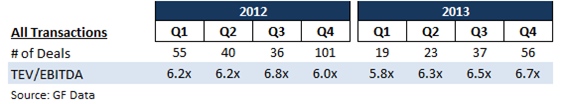

First, let’s review our high-level multiples and volume data for the past two years:

As has been widely noted by us and others, middle market M&A carried no momentum into the early months of 2013 after the tax-driven rush of fall 2012. Over the course of last year, there was a steady pick up in deal volume and in multiples.

GF Data regarded the multiple dip in Q4 12 and Q1 13 as a “false bottom,” occurring first as buyers extracted price concessions for accommodating closings prior to year end 2012 and then continuing as the market was dominated by weaker sellers inclined to close in the early months of 2013 even after the expected tax advantage was lost.

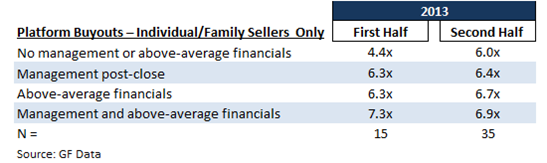

A closer examination of deals involving individual and family owned businesses supports this hypothesis. We drilled in on 83 transactions completed in 2013, all platform company buyouts. In addition, we cut the sample based on two significant drivers of deal pricing — financial characteristics of the target and continuity of management.

For the 50 deals in the sample involving individual/family ownership, here is how the data divides between the first and second six months of 2013:

- We think this data puts a spotlight on the “false bottom.” Individual/family owned business accounted for 68 percent of the sample in the first half of the year, 57 percent as volume rose in the second.

- The non-institutionally-owned businesses offering neither above-average financial characteristics nor a management solution post-close that continued the march toward closing in the first months of 2013 traded at an average of 4.4x TTM Adjusted EBITDA.

- In the same period, sellers with either above-par financials or management continuity were valued nearly two turns higher, at 6.3x.

- In the second half, volume picked up and — while there was little change in multiples for the businesses with better financials and/or management — valuations jumped for the individual/family owned firms with neither. There is an interesting cause/effect question here. It may be that volume rose in part because buyers starved for product were willing to meet the pricing expectations of the owners of these more pedestrian properties.

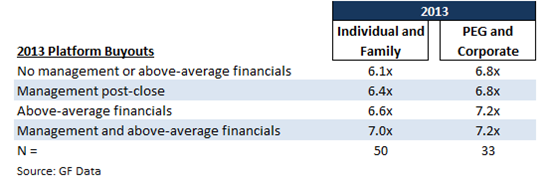

The individual/family-owned seller data for the year stands in contrast to the same data for private equity and corporate sellers:

- PE/corporate-owned businesses lacking above-average financial characteristics were valued at an average 6.8x — whether or not they came with management. Institutionally owned businesses are more likely either to be offered with management or sold to buyers with their own management in place. Only four of 33 deals in this group lacked a management solution. For the individual/family subset, 12 of 50 would require new management post-close.

- The institutionally owned businesses traded at a .7x premium to individual/family owned businesses without management or above-average financials. With either of these value enhancements added to the mix, the premium narrowed to .4x. The presence of both largely erodes the presumptive advantages given to a business being sold by an institutional owner; for that group the premium is only .2x.

Our data thus leads to or supports a number of conclusions about the mindset of the middle-market seller:

- Through the financial tumult of the last half dozen years, many individual and family business owners have come to the realization that a profitable closely-held business is a good thing to have.

- Having ridden out the downturn, they are as a group skeptical of suggestions that comfort comes from diversification of wealth, and remain comfortable having much of theirs concentrated in businesses and industries they know best.

- Private equity groups and corporations are more likely to make the sale decision based on a dispassionate assessment of an asset, perhaps in combination with external considerations such as the investment life of a particular fund. Most individuals and families, by contrast, needed to be propelled into the market by specific circumstances in the life of the business or its industry — what David Hellier of Bertram Capital, a Bay Area-based private equity firm, describes as “event-driven” selling.

- Demographic and social forces are reducing the impetus for business owners in their early-to-mid 60s to exit as a matter of course. Many expect to remain active in business well into their 70s — a shift from a generation ago. The technology we all use to mix work and leisure enables them to spend more time away from their companies without having to sell them. In established manufacturing, distribution and business service fields, it’s less common to see children going into their parent’s businesses, removing the need to secure ownership for a next generation of management.

- The result is that individual and family business owners continue to be able to pick their spots in a seller’s market — to a greater extent for better and larger businesses, but to a still-notable degree for less coveted properties.

- It is no surprise to see more private equity firms evolving or expanding from a change-of-control focus to accommodate minority investments and/or recapitalizations. Tim Clifford of senior debt provider Abacus Finance observes that their sponsor-driven deal flow includes more non-control investments and fewer buyouts than was the case in the past.

What do we see as 2014 unfolds? Continued slow, steady gains in completed deal volume. Intense upward pressure on pricing for larger, well-managed properties in attractive industry niches. A reward in value for those businesses versus others, but — due to a combination of seller inelasticity and scarcity value — less of a premium than you might think.

Andy Greenberg is CEO of GF Data and Managing Director of Fairmount Partners, an M&A firm. Both are based in West Conshohocken, PA. He received the 2014 Alliance of M&A Advisors (AM&AA) Middle Market Thought Leader of the Year Award.

© 2014 PEPD • Private Equity’s Leading News Magazine • 3-20-14