Rebound in Valuation, Deal Volume and Leverage in Full Swing

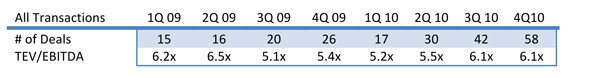

GF Data’s 2010 Year End Report reveals deal volume in the middle market surged ahead in 4Q 2010, marking the most deals done since the onset of the economic crisis, and reflecting continued improvement in the overall M&A market. The 155 private equity firms currently contributing to GF Data reported 58 completed transactions in the fourth quarter of 2010, closing out the year with a total of 147 completed deals.

For the third quarter in a row, completed deal volume was about double the rate of activity in the same period in 2009. PE firms in the GF Data universe completed 100 deals in the last six months of 2010, compared to 46 in the second half of 2009.

Average pricing held steady at 6.1x trailing twelve months adjusted EBITDA, the level reached in 3Q and the highest value since the first half of 2009, when “a flight to quality” pushed averages upward on lean volume.

The GF Data subscriber database now includes information on 1,104 transactions closed between January 1, 2003, and December 31, 2010 with enterprise values of $10 to 250 million. The full 4Q Report is available to subscribers only.

“We expected the 4Q report to reflect a lot of activity, based on the general sense of market improvement,” said Andrew T. Greenberg, CEO and Co-Founder, GF Data. “However, we never expected the quarter to be a peak unto itself, driven by tax anxieties and other considerations. There was plenty of momentum earlier in the fall, and we see every sign that this tempo will continue through the early months of this year.”

“The broader market dynamics beginning to take hold in the fall continued into 4Q. The premiums being accorded for better performing businesses and for larger deals have never been higher,” said B. Graeme Frazier, IV, Principal and Co-Founder of GF Data. “Total and senior debt multiples also held steady from 4Q, confirming that debt availability continues to improve at least somewhat in the middle market.”

“As the 4Q GF Data report shows, we are seeing a market that continues to improve quarter over quarter. However, there is still a significant disequilibrium between the supply of quality businesses in the marketplace and private equity demand to put money to work,” said Alan Mayer, Managing Director of GMB Business Advisors, a division of Green Manning & Bunch. “Despite the upheavals over the last two years, now is a good time to be a seller, as buyers look to deploy dry powder and the debt markets rebound.”

“Many of the sellers who wanted to take advantage of last year’s tax rates, but were too late to the party, are relieved by the extension of the tax rates, and are now gearing up to launch a sale process later this year,” added Chris Hammond, Managing Director of GMB Business Advisors. “With this in mind, we expect that the current dearth of supply will give way to a surplus toward the end of 2011, which will equalize the supply and demand equation.”

Data Highlights:

High-level valuation and volume data for the past eight quarters follows. GF Data Resources’ reports provide data contributors and subscribers with more detail on valuation, capital structure, leverage and key deal term trends.

- The “quality premium” discussed in recent GF Data Resources reports continued to be present in full force in 4Q. “Above-average” financial performers purchased in 4Q 2010 were valued at a 12 percent premium to lesser performers. The better performers accounted for 54% of completed transaction volume in 2010, up from 45% in 2009.

- The widening “size premium” reported on in the GF Data Resources 3Q report is also in evidence in the year-end data. Businesses with adjusted EBITDA greater than $6 million traded at an average multiple of 6.0x in 2010, compared to 5.7x for those below the $6 million mark. In 2009, those figures were 5.8x and 5.6x, respectively.

- Leverage multiples expanding at a greater pace than valuation multiples means that the unprecedented percentage of equity contributions reported through the first half of 2010 have begun to recede. Equity as a percentage of overall deal structure averaged 49.7% in 4Q, still high but down about 10 points from late 2008 and early 2009.

About GF Data Resources

GF Data Resources collects, analyzes and reports on middle market private equity sponsored M&A transactions with enterprise values of $10 to 250 million. Contributors and subscribers have exclusive access to detailed quarterly reports including extensive valuation and leverage data, breakdown by NAICS code through GFDR’s searchable online utility, and a new key deal terms quarterly report. The data provides private equity firms and other users more reliable external information to use in valuing and assessing M&A transactions. Transaction information is collected from private equity groups on a blind and confidential basis. Data contributors and paid subscribers receive two products — high-level valuation and leverage data in electronically delivered quarterly reports, and continuous access through the web site to detailed valuation data organized by NAICS industry code.

Data summaries and commentaries by GF Data CEO Andy Greenberg also are available at Private Equity Professional Digest’s web site, www.pepdigest.com.

Contact:

Jen Dowd

BackBay Communications

212-209-3844

jen.dowd@backbaycommunications.com