According to GF Data’s Third Quarter 2011 Report, valuations increased markedly for the quarter, averaging 6.4x trailing twelve months (TTM) adjusted EBITDA, the highest middle market purchase multiple since Q2 2009. The quarter was characterized by continuing unprecedented divergence in valuations between lower middle market and middle market transactions.

The “size premium” GF Data has been chronicling over the course of 2011 remained in full force. Based on total enterprise value (TEV) of the acquired companies, average multiples were as follows: 5.3x at $10-25 million TEV; 6.1x at $25-50 million; 6.9x at $50-100 million; and 8.3x at $100-250 million.

“As we have seen in previous quarters, private equity firms invest in above-average financial performers with roughly equal frequency across the middle market,” said Andrew T. Greenberg, CEO and Co-Founder, GF Data. “But, smaller companies with stronger EBITDA margins and revenue growth simply are not accorded the same premiums given to businesses that offer both strong financial performers and greater size.”

Businesses valued at $10-$25 million TEV the premium is only 101%, while companies in $50-$250 million TEV the premium is 106%.

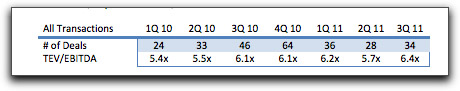

GF Data’s Third Quarter report encompasses 1,278 transactions involving firms valued at $10-250 million TEV reported by 183 private equity contributors. This cohort completed 34 transactions for the quarter, six more than the 28 reported for the second quarter.

This report also features expanded valuation parameters. GF Data included deals valued at 10-12x adjusted EBITDA, widened from 3-10x in prior reports. GF Data has always used 3-12x in the on-line searchable database available to contributors and paid subscribers. This change, which resulted in 36 transactions being added to the GF Data universe, was based on the conclusion that the narrower parameters were resulting in the exclusion of some highly valued transactions that deserved to be included in the aggregate data.

“Valuations on both smaller and larger deals are influenced more by the size of the deal. In the upper tier of the lower middle market, leverage availability is a greater differentiator when it comes to valuations,” said B. Graeme Frazier, IV, Principal and Co-Founder of GF Data. “While valuations in the $10-25 million and $25-50 million size range have remained in line with 2010 averages, the increasing multiples throughout 2011 have been concentrated in larger deals within our data sample, mostly because of increased lender interest.”

“As the Q3 GF Data report shows, middle market transaction activity remains strong – both from a volume and valuation perspective,” said David Dunstan, Managing Director at Western Reserve Partners LLC. “However, as the data also shows, we continue to witness a pronounced valuation gap between the upper and lower middle market. Lenders are eager to pump credit into larger deals and financial sponsors, still sitting on record levels of un-invested capital, have increased their equity contributions to remain active in an increasingly competitive environment. Nevertheless, we believe high quality companies will continue to garner premium valuations, regardless of size, and we expect deal volume to remain strong in Q4.”

The GF Data subscriber database now includes information on 1,550 transactions closed between January 1, 2003, and September 30, 2011 with enterprise values of $10 to 250 million. For information on subscribing, or on contributing data as a private equity participant, visit www.gfdataresources.com. The full 3Q Report is available to data contributors and subscribers only.

Additional Data Highlights:

High-level valuation and volume data for the past six quarters follows. GF Data Resources’ reports provide data contributors and subscribers with more detail on valuation, capital structure, leverage and key deal term trends.

- As mentioned above and in GF Data’s 1Q and 2Q reports, unprecedented differentials are emerging based on the size of the businesses being acquired. For the first nine months of 2011, the aggregate multiple is 6.1, but the breakdown by TEV is as follows: $10-25 million – 5.3x, $25-50 million – 6.1x, $50-100 million – 6.9x; and $100-250 million – 7.2x.

- Debt levels both reflect and contribute to these dramatic breakpoints in valuation. Total debt averages range from 2.9x at $10-25 million to 4.7x in the $100 -250 million tier.

- Over the eight-year life of the sample and in 2010-2011 year to date, the reward for better financial performance is highest in the $25-50 million grouping.

About GF Data Resources

GF Data Resources collects, analyzes and reports on middle market private equity sponsored M&A transactions with enterprise values of $10 to 250 million. Contributors and subscribers have exclusive access to detailed quarterly reports including extensive valuation and leverage data, breakdown by NAICS code through GFDR’s searchable online utility, and a new key deal terms quarterly report. The data provides private equity firms and other users more reliable external information to use in valuing and assessing M&A transactions. Transaction information is collected from private equity groups on a blind and confidential basis. Data contributors and paid subscribers receive two products — high-level valuation and leverage data in electronically delivered quarterly reports, and continuous access through the web site to detailed valuation data organized by NAICS industry code. For information on subscribing, or on contributing data as a private equity participant, visit our website at www.gfdataresources.com. Data summaries and commentaries by GF Data CEO Andy Greenberg also are available at Private Equity Professional Digest’s web site, www.pepdigest.com.

Contact: Jen Dowd BackBay Communications 212-209-3844 jen.dowd@backbaycommunications.com